- Offboard

- Posts

- These billion dollar AI bets quietly revealed where the next good jobs will be

These billion dollar AI bets quietly revealed where the next good jobs will be

Big money moved, big companies cut deep, and this week’s chaos shows exactly where you should aim your job search next.

"The best opportunities go to people whose reputation got them picked before anyone else knew the opportunity even existed."

-Farnam Street👋 Welcome, Jobseekers

Tech went full circus this week. Adobe tossed nearly $2B at Semrush, Intuit wired $100M plus to OpenAI, Anthropic flexed with a $50B buildout plan, Ramp crossed $1B revenue… and Verizon’s response was to drop 15,000 people. If you are job hunting, this is not “news,” it is a roadmap. The money is telling you exactly where the next real jobs will be. In this issue, we cut the fluff and turn the chaos into career ammo you can use right now.

📡 Career Radar: Adobe buys Semrush. Intuit bets big on OpenAI. Anthropic spends 50B. Here’s what it means for your career.

🎓️ AI School: AI Prompts You Should Be Using After This Week

📉 Layoff Report: Verizon planning its largest layoffs ever

📈 Trends & Data: Will Your Next Job Last 11 Months or 5 Years?

🔧 Jobseeker Tools: Wonsulting NetworkAI, CTRLpotato

Adobe buys Semrush. Intuit bets big on OpenAI. Anthropic spends 50B. Here’s what it means for your career.

This week’s tech news cycle sends a clear message: AI is no longer a side project as much as it is the infrastructure, and fintech is quietly roaring back.

Tech News Overview

On the AI side:

Adobe is buying Semrush for about $1.9B to fuse SEO and generative AI marketing.

Intuit signed a 100M plus deal with OpenAI to plug TurboTax, QuickBooks, and Mailchimp directly into ChatGPT.

Anthropic announced a gigantic $50B dollar data center build plan

AI dev tool startup Cursor raised funding at a $29B valuation to double down on AI coding assistants.

At the same time, non AI branded winners are emerging:

Expense management startup Ramp raised $300M at a $32B valuation and passed $1B in annual revenue, showing that boring but useful fintech is very much alive.

For jobseekers, this is a week to zoom in on AI powered products, fintech infrastructure, and the companies with fresh capital to hire.

Top Signals Jobseekers Should Care About

1. AI is embedding into “normal” software

Adobe x Semrush: Signals growing demand for people who understand both marketing and AI generated content.

Intuit x OpenAI: Puts AI inside tax, accounting, and email tools used by millions of small businesses.

So what: Even traditional SaaS companies now need product, design, and engineering talent who can ship AI powered features safely and in a way that normal users actually trust.

2. AI infrastructure is a long game

Anthropic’s 50B data center plan and similar moves from other players highlight huge demand for distributed systems, infra, and cloud talent.

Data center buildouts also pull in “unsexy” roles in operations, networking, and reliability.

So what: You do not have to be an AI researcher. Infra, performance, reliability, and platform roles tied to AI are likely to be in demand for years.

3. Fintech is a strong “non hype” bet

Ramp’s jump to a 32B valuation and 1B revenue shows investors still love products that help companies handle money and reduce spend.

Payments, expense, and B2B finance tools often adopt AI quietly under the hood.

So what: If you have any experience with payments, billing, risk, or compliance, this is a good time to lean into it.

Companies Worth Having On Your List

You do not need to apply to all of these. Use them as “anchor companies” to find similar players and competitors.

Cursor (AI dev tools)

Likely hiring engineers, product folks, and designers who understand developer workflows and IDEs. Position yourself as a builder who has shipped tools for engineers, not just models.Flatpay and peers (SMB fintech in Europe and beyond)

High growth payment companies aiming to become the next Adyen. Look for backend, payments, risk, and merchant experience roles. Emphasize simplicity and reliability in your portfolio.Anthropic and cloud providers

Roles in infra, distributed systems, AI safety, and developer platforms. Show any hands on work with LLMs, GPUs, or large scale systems.Ramp and other spend platforms (Brex, Airbase, etc.)

Great targets for product, design, and data roles focused on business workflows and financial decision support.

Moves To Make This Week

Use the news, do not just read it.

Add one concrete AI adjacent project to your resume or portfolio, even if it is a small side project.

Identify 5 companies from this week’s funding and partnership news, visit their careers pages, and send at least 2 thoughtful cold emails that reference the specific news.

Update your LinkedIn headline and About section with relevant keywords such as “LLM features,” “AI integrations,” “fintech APIs,” or “cloud infra,” wherever you truly have experience.

For any fintech or infra role you target, include a short line in your outreach that ties your work to saving money, reducing risk, or improving reliability. That is what these newly funded companies are selling.

Schedule one 20 minute call with someone in a growing sector (AI infra, fintech, or “AI inside” traditional companies like retail or finance) to ask how they see hiring shifting for the next 6 to 12 months.

This week’s game plan: follow the capital, respect the risks, and make at least one move that ties your story to where the market is clearly heading.

Which AI trend feels most relevant to your career? |

AI Prompts You Should Be Using After This Week

1. Turn this week’s winners into a personalized target map

Use funding and partnership news (Adobe, Intuit, Anthropic, Cursor, Ramp, etc.) to generate a focused target list.

PROMPT:

Here is my background and current target role:

[paste resume or short profile]

Here are links or summaries of this week’s big moves in AI, infra, and fintech:

[paste 5–10 headlines or links, for example Adobe–Semrush, Intuit–OpenAI, Anthropic data centers, Cursor funding, Ramp funding]

Analyze these and build a table with:

- Company

- Why this company is likely to hire in the next 3–6 months

- 3 most likely role titles that fit my background

- A 1–5 “hire now” score

- One sentence hook I can use in an outreach message to each company that references this week’s news.2. Design an “AI adjacent” project you can ship in 1–2 weeks

Tie your portfolio directly to the trends: AI in SaaS, infra, and fintech.

PROMPT:

Using this summary of this week’s tech signals:

- AI embedded into existing products (Adobe–Semrush, Intuit–OpenAI)

- AI infrastructure and data centers (Anthropic)

- Fintech growth (Ramp and similar)

And my skills:

[paste skills, stack, or past projects]

Propose 3 concrete, scoped side projects I could complete in 1–2 weeks that would impress hiring managers.

For each project, include:

- Which trend it aligns with (AI in SaaS, AI infra, or fintech)

- Problem statement

- Target user

- Core features only

- Suggested tech stack

- What metric or outcome it would showcase on my resume or portfolio.

Source: TrueUp

Verizon planning its largest layoffs ever

Verizon is planning to cut about 15,000 jobs in the telecommunications company’s largest-ever layoffs as part of a restructuring under its new CEO. The job cuts will impact 15 percent of the US-based company’s workforce, and are set to take place as soon as next week, the person said.

Tech firm Couchbase trims workforce after private equity deal

Cisco to lay off dozens in Israel as restructuring hits local operations

Fanatics to shutter Tampa distribution center, lay off more than 280

Playtika plans to cut 20% of workforce, up to 800 jobs at risk

Flipkart shutting down Israeli R&D center as global cost cuts deepen

Crystal Dynamics Lays Off 30 More Workers in Third Wave of Cuts This Year

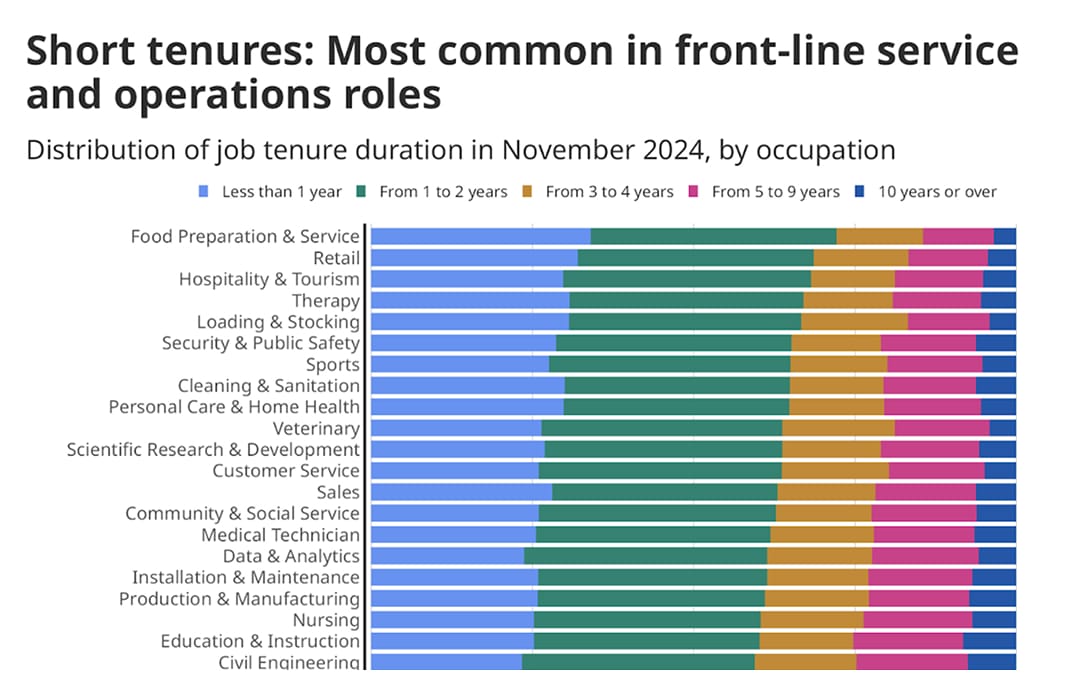

Will Your Next Job Last 11 Months or 5 Years?

Overview

Most US workers on Indeed stay just over 2 years in a job, but many start quietly job hunting again much sooner, according to Indeed Hiring Lab.

For tech and office workers, application activity is especially intense while they are still employed.

The Details

The median US job seeker on Indeed has been with their current employer 2 years and 3 months as of November 2024.

In food prep & service, over one-third have less than 1 year of tenure, twice the short-timer share in media & entertainment.

Among 500 common job titles, principals, drivers, and freelance creatives have almost 5-year median tenure; front-of-house teams sit at 11 months.

Across jobs that started July 2021 or later, median tenure is 18 months as of November 2024.

Around 16% of newly hired workers have applied to another job by month three; 57% apply at some point, averaging 6.5 applications monthly.

Application intensity is highest in IT infrastructure, ops & support, accounting, software dev, data & analytics, and marketing.

Why It Matters

For jobseekers, “job hopping” is normal at today’s pace. The median worker moves on in about 18–27 months, and many are browsing roles again inside their first year. Long walls of 5+ year tenure are now the exception, not the rule.

Tech & data ICs (eng, data, infra): Your crowd applies a lot while still employed. Expect hiring managers to assume you’re casually looking after 6–12 months, and use that to your advantage.

Leads & managers: In fields with longer tenure (management, legal, healthcare), multiple 3–5 year stints signal stability. One short hop is fine; a string of <12-month roles is a flag you’ll need to explain.

Front-line → tech switchers: Retail, food, and hospitality are high-churn by design. Frame short stays as normal for the sector and emphasize promotions, reliability, and survival in tough conditions instead of “loyalty.”

Wonsulting NetworkAI

Grow your network at the speed of AI

Land more interviews with NetworkAI. Find recruiters, hiring managers, and industry pros on LinkedIn, and get a fast pass to their email inbox with our cold emailing feature.

CTRLpotato

The fastest way from "uhh..." to "you're hired"

CTRLpotato runs your interviews, captures questions via audio, text, or screenshots and delivers tailored answers, just for you.

Reply