- Offboard

- Posts

- The Great Delayering... that never happened.

The Great Delayering... that never happened.

Amazon cuts, fewer managers, smaller teams, new hotspots for tech hiring. Here’s how to stay ahead.

"There is only one success—to be able to spend your life in your own way" -Journalist Christopher Morley👋 Welcome, Jobseekers

This week, we’re cutting through the noise. First up: the great delayering that never happened - ADP data says teams didn’t get bigger, just busier. Then we break down fresh layoff waves from Amazon to HP Indigo, peek at where tech jobs are actually growing (hint: think Mexico, India, and Manila), and spotlight a few tools - TripleTen and Prue - to help you stay sharp and interview-ready. Plus, we made a surprise stop at Trellis SF, a coworking oasis offering Offboard readers 15% off. Fewer managers, smaller teams, global shifts - let’s turn this week’s chaos into career clarity.

🧑✈️ Career CoPilot: The Great Delayering… that never happened.

📉 Layoff Report: Amazon is preparing to cut as much as 15% of its human resources staff

📈 Trends & Data: Why Tech Jobs Didn’t Freeze Everywhere: The Surprising Winners

🔧 Jobseeker Tools: tripleten, Prue

Amazon is preparing to cut as much as 15% of its human resources staff

Two sources told Fortune that Amazon’s human resources division—known internally as PXT or the People eXperience Technology team—will be hard-hit, but that other areas of Amazon’s core consumer business are also likely to be affected.

Source: TrueUp

142 people (6% of company) laid off at workflow automation company Bill

Amazon is preparing to cut as much as 15% of its human resources staff

Handshake's CEO Declares 'Refounding' Of His $3.5B Startup, All Around AI, affecting 15% of its employee base

HP Indigo’s workforce shrinks again as another 100 layoffs loom in Israel

Heart Machine making layoffs and ending development on Hyper Light Breaker

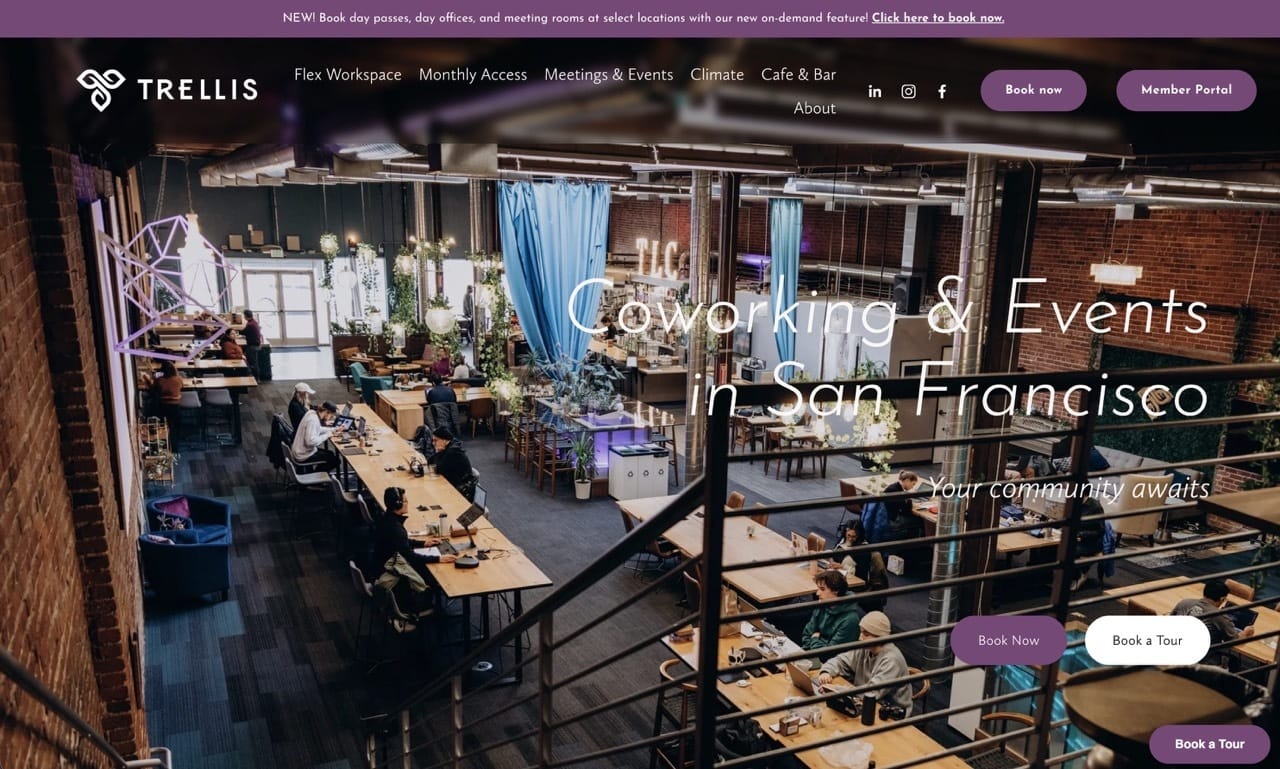

Did we step into a Coworking portal in S.F. this week?!

This week we wanted to get a feel for the S.F. Tech Week craziness and in an attempt to meet up with some new people, we ended up in a pretty heavy part of the Mission District. With emotions running high, heads on a swivel, we ended up at a coworking space named Trellis. The contrast from the city to this colorful, neon oasis truly felt like walking through a closet in Narnia.

After some introductions, Trellis wanted to extend an incentive to the Offboard community to use their beautiful coworking work space in SF. If you’re interested, use the discount code "OFFBOARD" which will get you 15% off your first day pass or meeting room purchase.

The Great Delayering… that never happened.

“Since much of the talk about managerial force reduction comes from tech executives, you might predict team sizes at tech companies would have grown… but they didn’t.”

Overview

Average team size hasn’t climbed, even after all the “delayering” talk. Tech teams are actually smaller, according to new analysis of ADP payroll data for 300,000+ workers from 2019–2025 in “Are teams getting bigger?”

The Details

Average team size fell from 7.4 (Jan 2019) to 6.9 (May 2020), then mostly recovered but stalled below pre-COVID levels.

Since 2024, team size ticked toward ~97% of pre-pandemic, but trend is weak and early.

Manager vs. team-member employment moved in sync post-recession, so no catch-up in team size.

Tech industry team size: 6.6 (Jan 2019) → 5.3 (May 2025). Non-tech closer to pre-COVID.

Tech teams in non-tech industries also shrank, mirroring tech-industry trend.

Tech teams at tech companies grew ~6.5% from May 2023–May 2025, still 8.1% smaller than 2019 and choppy. Possible tie to costlier R&D labor under §174.

Why It Matters

Hiring signal: Companies didn’t bulk up team sizes to offset manager cuts. In tech, teams are leaner. Expect hiring bars to stay high and roles to be broader.

Engineers: Smaller pods mean wider scopes; emphasize impact per head and cross-functional work.

Product/Design: Show “player-coach” chops and roadmap triage under tight staffing.

Managers: Headcount growth isn’t your leverage; pitch span-of-control efficiency and automation.

Actions You Can Take

Target tech firms where tech teams ticked up since mid-2023; pitch cost-efficient delivery under §174 constraints. Add a line on total cost of ownership per feature.

In your resume bullets, convert scope to “per-engineer throughput” (features or tickets per month per FTE) to match lean-team economics.

For manager interviews, bring a 1-pager on span-of-control experiments you’ve run (e.g., 1:7 vs 1:10) and outcomes.

If you’re IC in tech, prep a story showing you shipped with a team size ≤5. Tie to reliability or revenue.

Selling yourself to non-tech companies? Emphasize that tech teams outside tech also run lean; highlight self-sufficiency and tooling you own.

For R&D-heavy orgs, ask in screening: “How did §174 and the 2025 change affect team structure?” Tailor your pitch accordingly.

What’s was/is your team size? |

Why Tech Jobs Didn’t Freeze Everywhere: The Surprising Winners

Overview

Tech hiring cooled worldwide, but not evenly. According to Indeed Hiring Lab, emerging market economies (EME’s) are still 47% above pre-pandemic tech posting levels as of Oct 3, 2025.

Nerd Note: “EMEs” = emerging market economies tracked by Indeed (8 countries). Data are 7-day moving averages; most series seasonally adjusted.

The Details

US tech/math postings are down 35% vs Feb 2020. Similar drops in the UK, France, Germany, Canada.

Global tech postings across 27 tracked countries: down 18% vs Feb 2020.

Emerging markets (8 tracked): up 47% vs pre-pandemic; off 32% from 2022 peak.

India drives most EME tech postings; India up 45% vs pre-pandemic.

Mexico and the Philippines grew faster than India on a percentage basis.

EMEs’ share of global tech postings rose from 16% (early 2020) to 28% (mid-2025).

Within EMEs, tech’s share of all postings fell from 22% (peak) to 15% by Sep 2025, below 17% pre-pandemic.

Outsourcing may play a role, but not the main driver. AI roles are stronger in both AEs and EMEs; web/.NET/front-end are weaker in both.

Why It Matters

The center of gravity for tech hiring shifted. More roles are being posted in India, Mexico, the Philippines, and parts of the Middle East. But even there, tech is softer than other fields, and the hot categories rhyme globally: AI/ML wins, some traditional dev roles lag.

Engineers: Best odds in AI/ML, data, platform, and infra. Be cautious on front-end and .NET.

Data/AI pros: Skills travel well. EMEs show relative resilience and AI demand.

PMs/IT Ops: Ops/help desk track local economies. Target EMEs with growing non-tech hiring.

ResumeCo

FreeCareer Aptitude Test

Get personalized IT career recommendations based on proven psychological frameworks in just minutes.

Prue

Simplify & Speed Up Your Career Change with PruE

Struggling to turn applications into interviews? PruE's AI Resume Builder, LinkedIn Optimizer, Career Roadmap, Interview Prep, and a suite of additional tools work together to sharpen your story and help you land the next role with confidence.

Reply