- Offboard

- Posts

- Zuck’s Metaverse: A $58B Empty Mall

Zuck’s Metaverse: A $58B Empty Mall

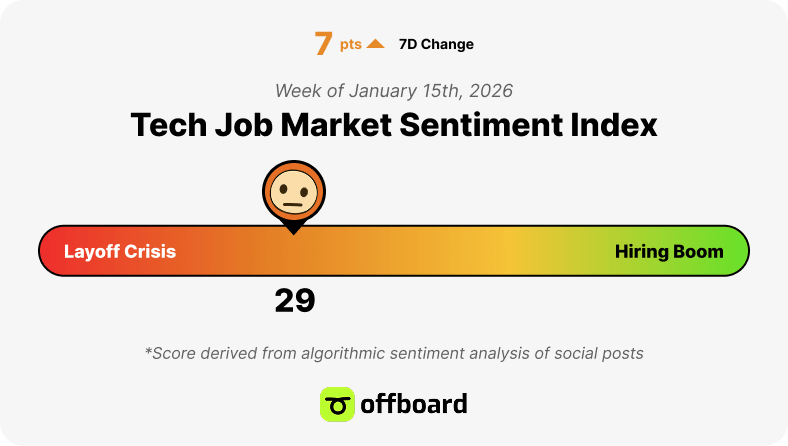

Best jobs in the US for 2026, layoffs swarm back led by Meta, and some hot companies to peep this week

"Edit yourself for approval and you become a minority shareholder in your own life." -FS👋 Welcome, Jobseekers

Welcome to the week where Meta lights another pile of cash on fire (hello, empty $58B metaverse mall) and then hands out 1,500 pink slips like it’s “streamlining season.” Meanwhile, the real hiring gravity is back in the boring, expensive, grown-up stuff: AI in healthcare, security, infrastructure, and the companies actually in build mode (Swap, Cyera, Deepgram, Anduril).

🧑✈️ Career CoPilot: Zuck’s Metaverse: A $58B Empty Mall

📅 Events: FounderNexus’ The Art of the Scrape: Doing More With Less

📡 Company Radar: Swap, Cyera, DeepGram, Anduril

🔈️ Signals of the Week: OpenAI + Anthropic push into healthcare AI,

📉 Layoff Report: Meta lays off 1,500 in the Metaverse

📈 Trends & Data: Best Jobs in the US for 2026

Ship the message as fast as you think

Founders spend too much time drafting the same kinds of messages. Wispr Flow turns spoken thinking into final-draft writing so you can record investor updates, product briefs, and run-of-the-mill status notes by voice. Use saved snippets for recurring intros, insert calendar links by voice, and keep comms consistent across the team. It preserves your tone, fixes punctuation, and formats lists so you send confident messages fast. Works on Mac, Windows, and iPhone. Try Wispr Flow for founders.

Meta lays off 1,500 in the Metaverse

Source: TrueUp

Meta is laying off 10% of staff in its Reality Labs division, which is core to developing the company’s VR and metaverse products. Reality Labs had roughly 15,000 employees, and the cuts could impact over 1,000 people.

Playtika to lay off about 500 employees in 15% workforce cut

StoreDot lays off dozens as it prepares for $800 million SPAC merger

Crypto exchange OKX cuts institutional staff amid global restructuring

Bay Area semiconductor testing company to lay off more than 200 workers

Kaseya Lays Off 5 Percent Of Workforce, Says The Move Is Aimed At Aligning ‘Go-To-Market Teams’

Foretellix lays off about 18% of its workforce as AI adoption reshapes operations

Rad Power Bikes closing stores in Vancouver, B.C., and Florida; 7 more will remain open

AI chip unicorn Hailo to lay off nearly 10% of staff as it refocuses on robotics and Physical AI

Angi to eliminate 350 jobs, citing ‘AI-driven efficiency improvements’

Ubisoft closes its recently-unionized Halifax studio, says it's not because of the unionizing

Source: TrueUp

FounderNexus Event: [Founders Only] The Art of the Scrape: Doing More With Less

In this session:

“We’re getting curated, venture-scale founders in a room to talk about the tactical, unglamorous side of resourcefulness. No generic advice. No "thought leadership." Just a high-bandwidth exchange of what’s actually working right now.”

FounderNexus is a community dedicated to venture-scale founders that focuses exclusively on developing Founders into the best version of themselves.

Top Signals of the Week

OpenAI + Anthropic push into healthcare AI. Both are launching health-focused experiences and positioning them as “serious tools,” not chat toys. Why this matters: healthcare has budgets, urgency, and compliance requirements. That combo forces hiring across product, security, data, and applied ML.

Anthropic’s $10B raise is a hiring gravity well. When a lab raises that kind of cash, it buys three things: compute, distribution, and talent. Why this matters: even if you do not want to work at a frontier lab, their spending creates second-order hiring in vendors, partners, and startups building on their models.

IPO window is cracking open (Discord, others). IPO prep usually triggers “adulting” hires: finance ops, analytics, security, enterprise GTM, reliability. Why this matters: late-stage companies often resume hiring to hit cleaner growth narratives before listing.

VC is back in frontier sectors. Big funds are raising massive pools and pointing them at AI, defense tech, security, and infrastructure. Why this matters: those sectors translate funding into headcount faster than consumer apps right now.

Rapid back-to-back funding rounds signal real demand. E-commerce enablement, cloud data security, and voice AI are getting stacked rounds.Why this matters: this is where near-term hiring shows up first, especially in product, platform engineering, and enterprise customer teams.

Zuck’s Metaverse: The World’s Most Expensive Empty Mall

Mark Zuckerberg renamed the whole company “Meta,” poured a comical amount of money into the metaverse… and then (oops) started treating it like that treadmill you buy in January and quietly turn into a coat rack by February.

The “Subsidized Ghost Town” Scorecard

According to the PDF’s roundup of reports and chatter:

Reality Labs burn: roughly $58B+ spent since 2019 (with some estimates pushing higher).

Horizon Worlds scale: peaked at under ~200k monthly users, with engagement described as withering after that.

Retention: only ~11% of users come back after week one, aka “one awkward VR hangout and I’m out.”

Creator economy, but make it lonely: fewer than 9% of worlds ever get 50+ visitors, which is an impressive way to build 10,000 unvisited rooms.

If you do the cursed math the PDF tees up, you get a vibe like: “We spent luxury-car money per user to create… legless avatars standing around in digital silence.”

The Pivot That Says Everything (Without Saying Anything)

After publicly doubling down on the metaverse vision, Meta’s Reality Labs cuts (around ~1,500 roles) are the quiet admission phase, with budgets shifting toward AI.

Career Signal (the part that’s not just comedy)

If you’re job hunting: Meta’s priorities look like AI-first funding and headcount, with VR “nice-to-have” bets getting treated like yesterday’s hype cycle.

Translation: follow the spend, not the speeches.

Teams Ready to Hire

Here are four targets that scream “build mode,” plus how to position yourself.

What’s happening: big funding, fast follow-on round, global commerce angle.

Likely roles: product (merchant tools), full-stack, platform, growth, partnerships, solutions.

Your angle: talk about scaling workflows, payments, logistics, and reducing friction for merchants. Show you can ship features that move GMV.

What’s happening: monster round, major enterprise traction, security is non-optional.

Likely roles: security engineering, cloud infrastructure, data classification, enterprise product, solutions engineering, sales ops, data analytics.

Your angle: emphasize trust, compliance, and measurable risk reduction. If you can translate messy data estates into clean systems, you are valuable here.

What’s happening: large raise, product expansion, acquisition to broaden vertical coverage.

Likely roles: ML engineering (speech), infra, API product, developer experience, enterprise implementations, integrations.

Your angle: show you can make complex tech usable. Portfolio wins here include real-time systems, developer tools, or shipping APIs people love.

What’s happening: defense tech is getting sustained funding and serious contracts.

Likely roles: real-time software, computer vision, robotics, systems, product for hardware-software workflows, program management.

Your angle: highlight reliability, security mindset, and comfort with real-world constraints. Bonus points for any gov or regulated-industry experience.

Pattern: the hiring heat is in companies selling into enterprises or governments, not vibes-based consumer products.

Best Jobs in the US for 2026

Indeed’s “Best Jobs in the US for 2026” points to concentrated growth: opportunity hasn’t vanished, it’s pooling in roles that combine specialized expertise with real-world accountability and trust.

Tech takeaway

Tech is in a rebalance. Many broad titles face tougher competition, but companies still hire for work that protects revenue, reduces risk, and keeps critical systems running.

Where jobseekers can still win

1) Specialize (don’t sound generic)

Lead with a clear wedge, not a catch-all title:

Security / privacy / compliance

Platform, reliability, and cost efficiency

Data science that ships to production

Enterprise systems + workflow automation

2) Get closer to “must-have” work

Target teams tied to core outcomes: uptime, risk reduction, fraud/pricing/ops analytics, and mission-critical software.

3) Follow growth gravity without a full pivot

Healthcare is a major growth engine overall, which boosts demand in healthcare-adjacent tech: providers/payers, benefits, revenue-cycle, regulated data, security, and interoperability.

Moves to make this week

Pick one lane (one-sentence positioning).

Pick 15 target companies where that lane is essential.

Build one proof artifact (case study, architecture note, dashboard demo, PRD teardown, or postmortem).

Update your headline + top bullets to quantify outcomes (cost, uptime, revenue, risk).

Bottom line

In 2026, interviews come from clear positioning + credible proof, not from spraying more applications.

Reply